Available by Email Only!

______________________________________________________________________________________________

AV SPECIAL BULLETIN #

1, 3-19-22

______________________________________________________________________________________________

“We

are not in Kansas Anymore” |

Since 2008 when then Fed Chairman Bernanke

cut the Fed Funds rate to zero, US financial

markets and consumers have been living a dream: low interest loans

& mortgage

rates at or below the rate of inflation. Essentially free money.

Since 2010, the FED has tried

to raise the inflation rate and get it to trend above 2.0%, but

could not. This time period

of low inflation and a Fed Funds rate of near zero, I refer to

as “Kansas”. It will soon

be apparent that interest rates “are not in Kansas anymore”.

The stock market began to

realize this in January and thus far has had a terrible year.

An old lesson is going to be retaught: the cost of capital affects

the economy and markets.

The reality is that……

We are now in a new FED tightening cycle. The last FED tightening

cycle was 2018.

From Dec 2015 through Dec 2018, the FED raised the Fed Funds rate

8 times to 2.0%,

with each rate hike a 1⁄4%. In the fall of 2018, in various

speeches, Chairman Powell

indicated that 3 more rate hikes in 2019 were possible. At the

time the FED was trying

to “normalize” interest rates, i.e., get the FF rate

back to 3.0%. The FED’s schedule

to normalize interest rates was just too much and too fast for

markets at that time. You

might recall financial markets had a horrible Q 4 in 2018. Due

to all of the ruckus, the

FED backed off and the financial markets calmed down. By July

2019, because the

economy was slowing, the FED went back to cutting interest rates

again.

What has changed, what’s different? In 2018, the FED had

the flexibility to slow down

their rate hikes because at that time we were still in a world

of 2% inflation, but today

we have nearly 8% inflation.

THE most important monthly economic number that comes out now

is the CPI, the Consumer

Price Index. Even though the FED, on March 16th made their first

rate increase in 3 years, the

CPI has been affecting interest rates and all financial markets

since December.

In the latest CPI report on March 10th, the CPI was up +7.9% YoY.

On March 15th, the wholesale

inflation number was released, called the PPI, and was up +10%

YoY. Wholesale inflation is

seen as a precursor to the CPI as wholesale prices eventually

work their way into retail prices.

While the oil market and energy get all of the blame, price rises

in the CPI are broad based.

This means that higher retail inflation (CPI) numbers are probably

coming.

______________________________________________________________________________________________

Since 2000, the CPI

has climbed +62%.

______________________________________________________________________________________________

Unless you are 65+ years old, you are about to experience something

never seen in your life

time: a FED tightening cycle FORCED upon the US economy by high

inflation. This last

occurred in the late 1970’s as Jimmy Carter was preparing

his reelection campaign. Carter

appointed G. William Miller as FED Chairman in March 1978. Miller

was appointed to dampen

inflation, which at the time was on the rise. Miller inherited

a high inflation economy and high

oil prices by OPEC. OPEC was raising prices because the US dollar

was losing value due to the

higher inflation. Oil trades in US dollars. Miller was not in

favor of raising interest rates and

risking recession. Miller told Carter that a recession would make

inflation worse. By March

of 1979, it was apparent to Carter that Miller was not going to

be dragon slayer needed to kill

inflation, and save his reelection. FED Chairman have a 4 year

term and Miller was only in yr 1,

so to get Miller out, Carter appointed Miller to be Secretary

of the Treasury, which opened the door

for a new FED Chairman. In Aug of 1979, just 14 mo before the

next Presidential election,

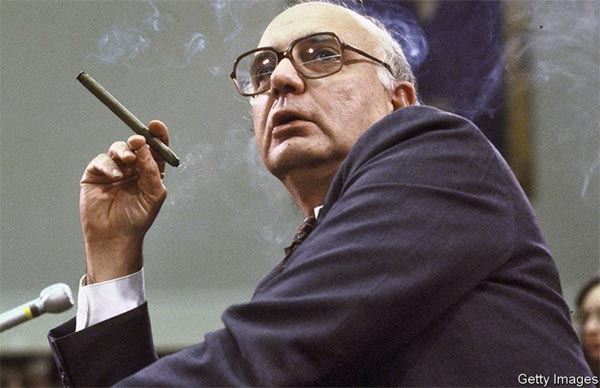

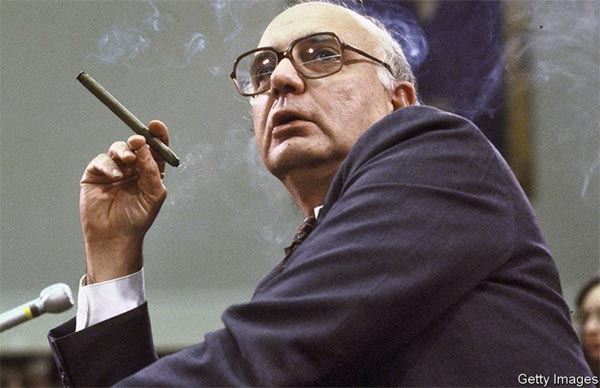

Paul Volker was sworn in as FED Chairman. Besides being very intelligent,

Volker was

not intimidated by politicians. At 6’ 6’’, when

he walked into a room, he had a real presence,

thus his nickname “Tall Paul”. Volker was also well

known for his love of cigars.

Volker in a Congressional hearing.

While known today as the man who killed inflation, and highly

respected for it, at the time of his tenor,

Volker was very unpopular- even hated and despised. History has

a way of correcting the “emotions of

the moment”.

This is what Volker walked into in Aug of 1979. The CPI was running

at 11.8%. It was rising almost

1% per month. Volker knew that strong medicine was needed, and

that it would be very unpopular.

The speculative behavior in the US economy needed to be squeezed

out by raising interest rates and

turning investors and consumers back into savers. This meant recession.

In Aug of 1979, the Fed Funds rate was 8.0% with inflation at

7.8%. This is an important point because

it demonstrates, that even a FF rate at the same level of inflation

did not slow it. From Aug of 1979 thru March

of 1980, the CPI moved up to 14.8%. During this same 7 mo period,

Volker moved the FF rate from 8%

up to 20%. Volker moved the FF rate up by 12%, unheard of numbers

today, let alone in just 7 months.

At the time I had my money in a money market fund at Dreyfus and

was yielding 17%. With such high

savings rates, and no risk to them, everyone became savers. By

March of 1983, the CPI was back down at 3.6%.

While Volker’s actions were effective in taking out inflation,

there was also a high cost on the economy.

The economy went into recession and the housing market slowed

dramatically becoming an “owner will carry”

market. The unemployment rate rose from from 6.0% in Aug of 1979

to 8.6% in Jan 1982, one year into

Reagan’s first term. In 1981-82, if someone had $50,000

to buy a home, he could not, because mortgage rates

were so high, he could not qualify for the loan. In 1981 mortgage

rates were over 16%. You can probably

imagine, that during this time period, Volker was under tremendous

pressure from Congressional leaders to

lower interest rates immediately, that the pain was too great.

Volker’s basic premise was that if inflation was

not defeated, and our money became “monopoly money”,

then nothing else would matter. To defeat

inflation now and set a foundation for a low inflation recovery,

the nation needed to take the pain now,

for the gain later. The foundation of low inflation that Volker

laid, lasted through 2020, 40 years.

Unfortunately, politicians have short memories, forcing all of

us to have to relearn the lessons of the past.

In view of this history, what are the implications for the present

FED? No one on the FED wants to be

remembered as the FED that let the inflation genie out of the

bottle. But too late for that, it’s out. This FED

will have to settle for getting inflation back down, hopefully

substantially. The important question to ask

though is, what rate of inflation will this FED consider a victory?

We cannot know this with certainty, but

since Chairman Powell has said several times that he wants inflation

to trend above 2.0%, we could make

a modest guess and say 3% - 4% could satisfy this FED.

What is the FED doing now? The FED has clearly stated that beating

back inflation is now their primary

goal. The labor market will have to fend for itself; no problem,

as it has a surplus of job openings.

On March 16th the FED announced their first Fed Funds rate increase

in 3 years, moving it up to .25-.50%.

The FED also announced they are stopping Quantitative Easing (QE),

the FED’s buying of bonds in Treasury

auctions to artificially support lower rates. The bond market

will revert back to a pure auction market at the

qualms of “the market”. This alone should put upward

pressure on interest rates.

The FED also owns about $9T in debt, often referred to as their

“balance sheet”. The FED did not discuss

on March 16th when they would start paying this down, but when

they do, that too is considered a factor

that will also put upward pressure on interest rates.

The FED has laid out a time table for 6 more rate increases this

year. Assuming all 6 are .25% increases,

by December that will put the Fed Funds rate at 1.75%, perhaps

2.0%. With inflation right now at 4 X this

projected FF rate, that tells you we have a serious inflation

problem, now, and in the making. And if

inflation keeps rising, above the 8% where it is now, the medicine

needed will be even higher rates.

Remember, to really kill inflation, Volker had to raise the FF

rate well over the inflation rate.

Do you think anyone on this FED has it in them to raise the FF

rate to even 4%, let alone the

8% where the CPI is now running? No they don’t, at least

not now.

Chairman Powell’s forecast for inflation is that it will

be lower in Q 4 than now. But he is also the

one who said in mid 2021 that inflation was transitory, only temporary.

Powell has since admitted

he got that wrong.

The FED’s goal here is the “holy grail” of FED

lore: the soft landing, slow inflation without a recession

If the Powell FED can do this, they will be the first FED to do

so. That alone tells you the odds are

not good for a “soft landing”.

It appears to me that the FED is banking on the supply chain backups

to improve and increase the supply

of goods, which could help lower prices, and thus help the CPI.

Combine that with a rising FF rate

and the FED is hopeful that inflation will work its way lower

in the second half of 2022. In theory,

that could work.

It’s a safe bet that no one on the FED is Paul Volker, or

probably wants to be, so in my view, the best

that this FED will do in getting inflation lower will be in the

area of 4%. Cutting it in half from

its current level would be hailed as a big victory.

To Chairman Powell’s credit, he did say, “If inflation

does not come down as we foresee, the

FED could raise interest rates more quickly.” This means

1⁄2% to 1% moves up in the FF rate,

vs the gradual approach of 1⁄4% hikes we see now.

But what if inflation keeps rising, moving higher as the FED slowly

keeps raising the FF rate?

If this happens, we could have a replay of the early 1980’s,

where FED Governors finally

realize the only way to beat inflation is to cause a recession

with even higher interest rates.

Will Powell play the role of William Miller and have to resign,

or will Powell stay on board

and become a “Volker”. To be the first to do anything

big, takes real courage. Volker was the

first to raise interest rates to recessionary levels, and do it

knowingly, but did it anyway because

he knew it was the only lasting cure. If Powell, or the next FED

Chairman, has to go “Volker”

they will have history on their side.

Implications of higher interest rates for housing and land sales.

HOUSING

Obviously as mortgage rates go higher, with inflation rising faster

than wages,

the amount of money one can borrow to buy a home goes down. Mortgage

rates were 3% + in December. Today they are approaching 4.5%.

Millennials

looking to buy a home are screaming bloody murder because they

can

no longer get a mortgage that starts with a 3. At some point,

as home sales

slow, home prices will start to come down. This is when you find

out who really

wants to sell their home. Face reality, this is inevitable. The

only question is, how

long will this process take to begin and how long will it last.

My bet it will begin

by June, or certainly by the second half of this year.

The FED will NOT be able to begin their next cycle of interest

rate cuts until inflation

is under control. The definition of “under control”

could vary as to other circumstances

in the economy.

LAND

What about land sales? Historically, land sales have always followed

the housing market,

but with a lag. Housing sales will slow first, then land will

follow. The lag could be up to

6-12 months. This means land sales could still be fairly good,

while the housing market

is having obvious problems. Almost all land deals are cash, no

borrowed money, so land

buyers will not go through interest rate shock at the time of

purchase like a home buyer.

If I am right on my macro picture described in the bulletin, then

2022 and maybe part of

next year, will be a much better time to sell your land, than

beyond that period.

Sometimes nothing happens for decades, the suddenly, decades happen

in weeks.

Remember……………..“Things Change”.

Questions? Need help or advice?

Call OR email.

Jim Patton, Broker

http://www.avLand.info

“since 1985, helping investors make

informed decisions"

BRE # 00776290

Office, outside AV 800-270-8770

Office, inside AV 661-943-8090

Fax - 661-793-7269

Jim Patton

jim@jpbroker.com

|